The United States is grappling with a severe housing affordability crisis that is making homeownership a distant dream for many Americans. Exacerbated by restrictive NIMBY land-use policies, the current situation reveals significant shortcomings in housing market regulations that stifle construction and drive up prices. Since 1960, the cost of new single-family homes has skyrocketed, leading to homeownership challenges for a growing number of individuals and families. Additionally, a decline in construction productivity has further complicated the landscape, limiting innovation within the housing sector. To address these pressing issues, a comprehensive understanding of the interplay between regulatory frameworks and construction practices is essential.

Across the nation, the struggle to find affordable housing options has reached critical levels, prompting discussions around the factors contributing to this dilemma. As communities grapple with the implications of restrictive land-use policies often driven by local residents’ preferences, the dynamics of the housing market continue to evolve. The persistently high costs of new homes present formidable homeownership hurdles for prospective buyers, while the construction industry faces its own set of challenges, including reduced productivity and stalled innovation. This situation calls for a closer examination of the regulations governing development and how they hinder progress in the housing sector. Understanding these interconnected issues is vital for crafting solutions that will foster a more equitable and accessible housing environment.

Understanding the Housing Affordability Crisis

The housing affordability crisis in the United States has escalated significantly over the past few decades, making homeownership increasingly elusive for many Americans. Rising home prices, driven by various factors including increased labor and material costs as well as stringent zoning regulations, have compounded this issue. A recent study highlights that without a viable path to affordable housing, especially for first-time homebuyers, the dream of owning a home may soon become just that—a dream.

At the heart of this crisis lies the interplay between local land-use policies and market demands. Regulations created under NIMBY (Not in My Backyard) sentiments have placed substantial restrictions on new construction projects, which in turn hampers the ability to increase housing stock effectively. Consequently, as demand continuously outstrips supply, prices rise, and with them, the barriers to homeownership grow more formidable.

Frequently Asked Questions

What impact do NIMBY land-use policies have on the housing affordability crisis?

NIMBY (Not In My Backyard) land-use policies significantly contribute to the housing affordability crisis by restricting the types and sizes of housing developments permitted in various communities. These policies create barriers that prevent larger, more efficient construction projects, which would otherwise lower costs through economies of scale. As a result, the housing market becomes less productive, leading to higher home prices and making homeownership increasingly unattainable for many.

How do housing market regulations contribute to the housing affordability crisis?

Housing market regulations often exacerbate the housing affordability crisis by imposing stringent requirements on zoning, density, and design. These regulations limit the ability of builders to respond to market demands effectively, reducing construction productivity. Consequently, fewer homes are built, driving up prices and making it difficult for potential buyers to achieve homeownership.

What are the homeownership challenges leading to the housing affordability crisis?

The housing affordability crisis presents numerous homeownership challenges, including skyrocketing prices, limited inventory, and increasing competition among buyers. Regulatory barriers, such as NIMBY land-use policies, have stifled new construction, contributing to a lack of affordable housing options. Many potential homeowners find it difficult to save for a down payment or qualify for mortgages, further diminishing the pathway to homeownership.

How has the decline in construction productivity affected the housing affordability crisis?

The decline in construction productivity directly affects the housing affordability crisis by limiting the number of homes built and increasing construction costs. Factors such as smaller project sizes driven by NIMBY land-use policies have led to less efficiency and higher prices. As fewer homes are constructed, demand outstrips supply, raising prices and making housing less affordable for a broad segment of the population.

What role does housing sector innovation play in resolving the housing affordability crisis?

Housing sector innovation is crucial to addressing the housing affordability crisis, as advancements can lead to more efficient building processes and cost reductions. However, the decline in innovation since the 1970s, attributed to restrictive housing market regulations and smaller construction firms, has hampered improvements in productivity. Encouraging innovation in construction techniques, materials, and housing designs could alleviate some of the pressures causing rising home prices.

How can addressing NIMBY land-use policies help mitigate the housing affordability crisis?

Addressing NIMBY land-use policies can significantly mitigate the housing affordability crisis by easing restrictions on housing development. By allowing for larger projects and greater density, developers can take advantage of economies of scale, increasing the overall housing supply and reducing costs. This would not only help lower home prices but also make homeownership more accessible for more people.

What historical trends in construction have led to the current housing affordability crisis?

Historically, the construction industry experienced significant productivity growth until regulation began to tighten in the 1970s. This shift reduced the size of construction projects and the emergence of smaller firms, which has since hindered innovation and efficiency. The result has been a slowdown in housing production, leading to higher costs and the current housing affordability crisis.

| Key Point | Details |

|---|---|

| Rising Housing Costs | The price of new single-family homes has doubled since 1960, driven by factors including labor and material costs. |

| Impact of NIMBY Policies | Tighter land-use controls have limited larger building projects, leading to increased costs and reduced productivity in the housing sector. |

| Decline in Construction Productivity | Construction productivity has fallen by 40% from 1970 to 2000, contrasting with advancements in other industries like auto manufacturing. |

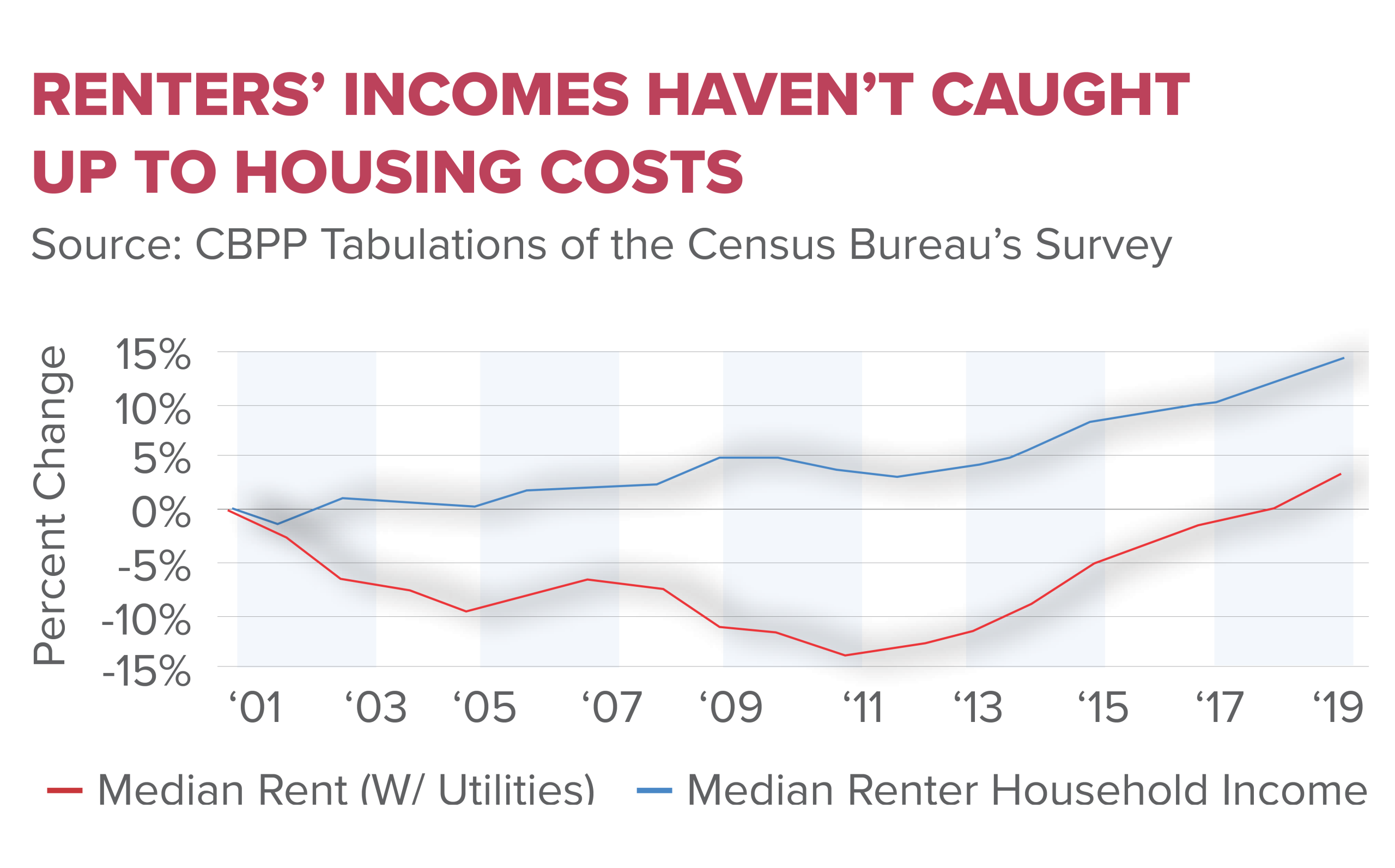

| Generational Wealth Disparity | Younger generations have seen a significant decline in housing wealth compared to older demographics, exacerbating the housing affordability crisis. |

| Need for Innovation | The construction industry has lagged in innovation and patenting, significantly reducing efficiency compared to historical productivity levels. |

Summary

The housing affordability crisis has become a pressing issue in the United States, as ownership continues to slip out of reach for many Americans due to rising costs and restrictive land-use policies. Analysis shows that these ‘not in my backyard’ (NIMBY) regulations have stifled productivity and innovation in the housing market. Without addressing these regulatory barriers, the situation will likely worsen, highlighting the urgent need for reforms aimed at increasing housing availability and affordability for future generations.